Just 3 in 10 Americans aspire to the C-suite, according to new Empower research

Just 3 in 10 Americans aspire to the C-suite, according to new Empower research

Money is the top driver of job satisfaction over moving up the ladder; study reveals a “Workplace Wishlist” of benefits people value.

Money is the top driver of job satisfaction over moving up the ladder; study reveals a “Workplace Wishlist” of benefits people value.

Who wants to be the boss? Just 3 in 10 Americans* say they aspire to a C-suite role, according to new research from Empower, a leader in financial planning,1 investing, and advice, with Millennials showing the highest interest in becoming a top executive (39%). In fact, 31% of people don’t want their job description to change – even if it means sacrificing a promotion or raise.

Money is the number one driver of job satisfaction (67%) over being a boss: a higher salary, which many Americans believe is linked to financial happiness, trumps the value people say they place on being an inspiring leader and leading by example (32%). Still, many are stressed about working with an incompetent manager (24%) or colleagues (26%). People say work satisfaction comes from being rewarded for loyalty and longevity at a company (40%) more than taking on challenging projects (24%) and recognition for the job performed (34%).

For some, there may be a paycheck paradox – a chicken or the egg dilemma: 38% (and 55% of Gen Z) believe they don’t get paid enough to go above and beyond their current job description. At the same time, nearly 1 in 4 people say they’re not working at full capacity, and nothing will motivate them to work harder (23% overall, 37% Gen Z).

More Americans plan to increase their contributions to their retirement savings in 2024 (34%) than ask for a promotion (23%) or quit to find a higher paying job (14%). Of all generations, Gen Z is looking to make more money by “job zwitching” (16%).

So if less focus is placed on rising through the ranks, what do people value at work? Respondents point to greater access to financial advice and benefits; over 2 in 5 Americans (44%) wish their employer offered more one-on-one financial help.

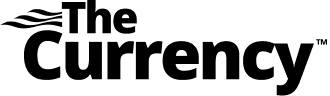

The “Workplace Wishlist” people are seeking:

- Advice advantage: 39% say their employer doesn't offer enough financial planning support. Half (48%) say financial coaching is a major must-have and 52% wish their job would provide more financial literacy opportunities.

- Retirement roll: 71% of Americans say retirement plan matching is an important employee benefit and over half (54%) wish their job automatically enrolled them into a 401(k) plan.

- Betting on a bonus: Bonuses are important to 75% of Americans, though nearly 1 in 5 respondents (17%) say their employer doesn’t offer one. One in 4 put their annual bonus towards essential items (24%), savings (44%), and retirement (28%), though 32% plan to spend it on a vacation.

- The big flex: 48% say they'd be willing to go back to the office if their employer offered a four-day work week – just 6% would be willing to take a pay cut to go remote. On the flip side, 1 in 4 Americans (26%) say if their employer asks them to go back to the office more this year, they'll quit.

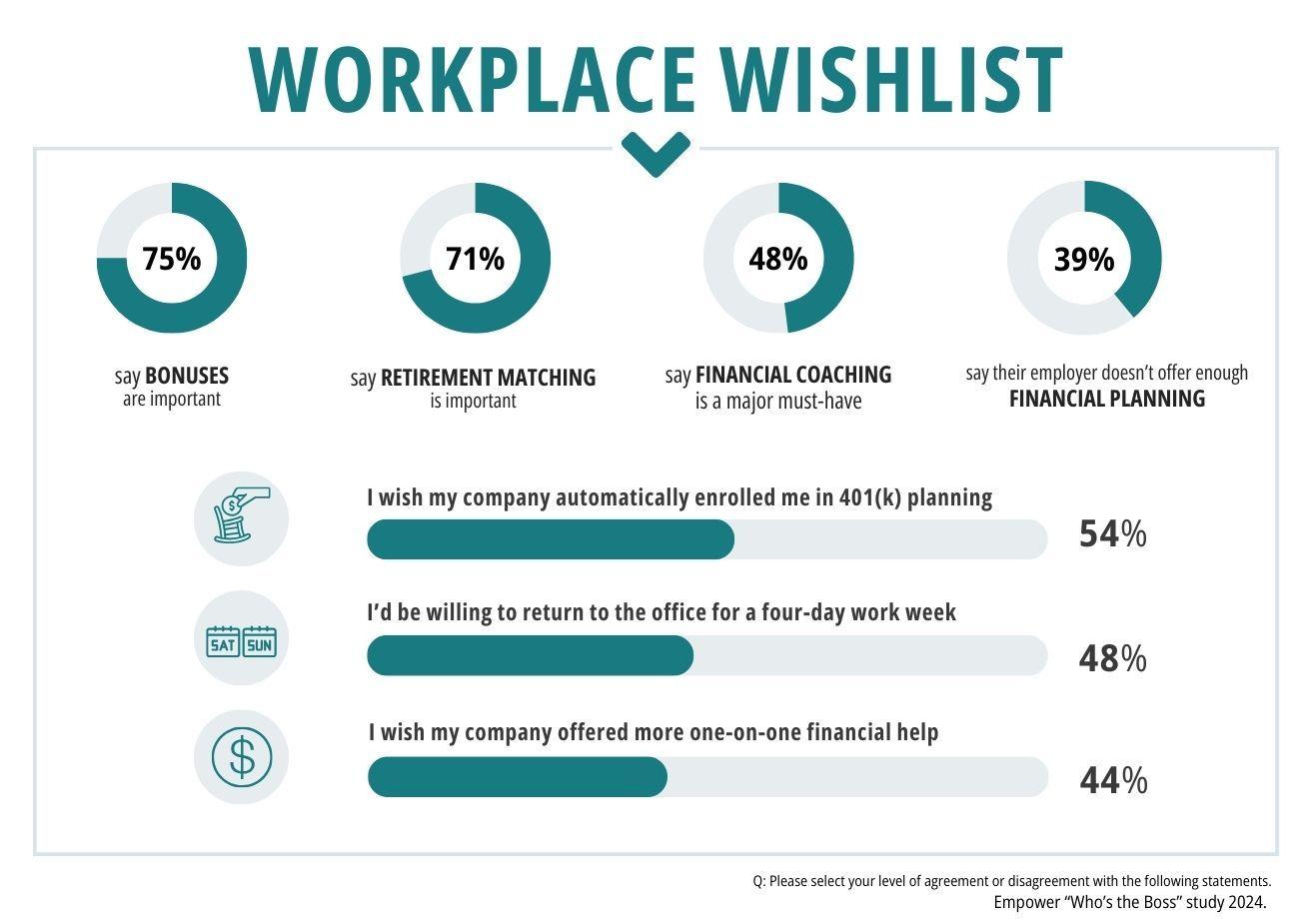

- Paycheck principles: When it comes to salary/compensation goals in 2024, Americans are focused on making enough money to pay their bills on time (45%) and to retire when they want to (39%). Over 1 in 4 want to make enough to avoid working multiple jobs. Some 34% feel their paycheck isn’t enough to cover their mortgage, but confidence remains strong: 58% of respondents believe they will continue to make more money.

Working to stay current on planning, saving, and investing for life?

Making money in 2024: Economic outlook

Six in 10 people feel their income isn’t keeping up with inflation and the cost of living, and only 11% “strongly agree” that inflation will go down (33% agree overall). These two factors are the top economic concerns for those surveyed (inflation 42%, cost of goods 23%), which far outweighs worries about the strength of the job market (7%) or career growth (4%).

Despite these concerns, just a third (31%) plan on asking for a raise this year, and the trend of “quiet quitting” seems to be waning: 9% plan to employ this strategy in the year ahead. Some 44% feel they make enough money to live comfortably, and overall, Americans feel optimistic about the future – just 5% listed the stock market as an economic concern, and most are bullish about their earning potential (64% men, 50% women) looking ahead.

*ABOUT THE STUDY

The Empower “Who’s the Boss” study is based on online survey responses from 1,117 American workers ages 18+ fielded by Morning Consult from January 3-4, 2024.

Get the scoop on your money.

Stay current on planning, saving, and investing for life.

1 Empower Advisory Group, LLC, a registered investment adviser, provides financial planning services using the MoneyGuidePro tool. MoneyGuidePro is not affiliated with Empower Retirement, LLC and its affiliates. Empower Retirement, LLC and its affiliates are not responsible for the third-party content provided.

On August 1, 2022, Empower announced that it is changing the names of various companies within its corporate group to align the names with the Empower brand. For more information regarding the name changes, please visit empower.com/name-change.

Securities, when presented, are offered and/or distributed by Empower Financial Services, Inc., Member FINRA/SIPC. EFSI is an affiliate of Empower Retirement, LLC; Empower Funds, Inc.; and registered investment adviser Empower Advisory Group, LLC. This material is for informational purposes only and is not intended to provide investment, legal, or tax recommendations or advice.

The information contained herein is being provided for discussion purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy or sell securities. All visuals are illustrative only.

“EMPOWER” and all associated logos, and product names are trademarks of Empower Annuity Insurance Company of America.

IMPORTANT: The projections or other information generated by MoneyGuidePro regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. MoneyGuidePro results may vary with each use and over time. Empower Retirement, LLC and its affiliates are not responsible for the third-party content provided.

Advisory services are provided for a fee by Empower Advisory Group, LLC (EAG). EAG is a registered investment adviser with the Securities and Exchange Commission (SEC) and subsidiary of Empower Annuity Insurance Company of America. Registration does not imply a certain level of skill or training. Investing involves risk. Past performance is not indicative of future returns. You may lose money. All visuals are illustrative only. Actors are not EAG clients.

“EMPOWER” and all associated logos and product names are trademarks of Empower Annuity Insurance Company of America.

© 2024 Empower Annuity Insurance Company of America. All rights reserved.

RO3376569-0224

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.

Advisory services are provided for a fee by Empower Advisory Group, LLC (“EAG”). EAG is a registered investment adviser with the Securities and Exchange Commission (“SEC”) and subsidiary of Empower Annuity Insurance Company of America. Registration does not imply a certain level of skill or training.